|

Monday, January 11, 2010 Edited: Saturday, July 17, 2010 Re: Adoption of "System-Accounting" Platform to Maximize Tax Collection Efficiency & Transparency Dear Officials & Representatives of the State of California: The past few years have been some of the most difficult in the state's entire history due to its towering financial difficulties. In plain speak, the government of California is required to spend more than it earns at the present and it will continue to do so until the cost of actually running an economy is reduced, and becomes "plain speak" for all its stakeholders.

The ProblemThree primary and interdependent issues are to blame for this enormous discrepancy between what a government earns versus what it spends:

The mingling of these three highly prohibitive circumstances comprises what is the crux of the systemic financial burden being endured by the state's constituency and its well-intentioned representatives.

The SolutionAs a lifelong student of physics, I am currently underway with publicly announcing my thesis that the entire study of economics is but a branch of physics which examines how humans cope with the laws of conservation of matter and energy rather than some dissociated concept of scarcity. By taking such an approach, we are able to treat the movement of value (money) as something that is governed by vectors (our financial promises to one another). It isn't necessary to get more technical than this except to state that if people were capable of inserting their promises into a system that measured and automated them, all three issues above would undoubtedly disappear. The opportunity of consumers to make a purchase at a retail store AND simultaneously remit payment of the sales tax for an instant tax collection at no operating cost to the government is now very real. It is because transactions are taking place within a system that also recognizes people's promises to one another, and automates them, that multiple and miniscule allocations can be instantaneously achieved. And as long as access to such information is deemed legal, all pertinent information involving the fiscal performance of an entity, of any size, can likewise be achieved. The long awaited day of eliminating information asymmetry is here. Ladies & gentlemen, I'd like to introduce you to EquilCurrency LLC (EQC). EQC is the first firm to use the system-clock (patent pending from AccelVal Technologies Institute LLC) in a financial application that establishes a "system-accounting" platform that behaves as a kind of sub-atomic accounting program for entire financial systems. While making the process of transacting absolutely effortless and immediate within the system, all non-private information about trade (which includes taxes) is made available to the public through a standard query one might conduct using a common search engine.

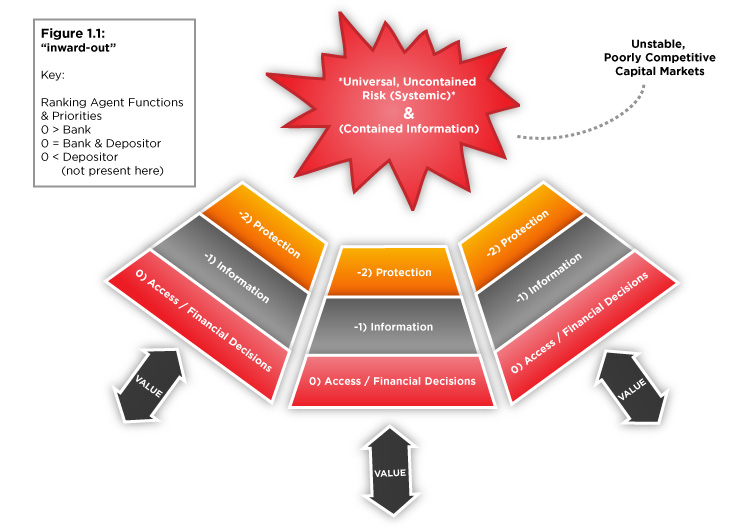

How It Works At The Macro LevelThe concept of a bank is in desperate need of revision since its current one as a business model has evidenced massive failure. The present definition of a bank is an institution that stores (protects) AND loans (invests) money. According to agency theory, such a definition ensures the worst possible outcome because protecting an asset while simultaneously exposing it to risk will, and most certainly does, produce what is the current system-wide fiduciary conflict that rewards withholding most all of the vital information required for the market-at-large to properly host a healthy competition for the highest risk-adjusted rate of return. Monopolizing such information inarguably leads to competitive failure within capital markets, and ultimately, system-wide failure in the presence of bank-risk insurance (see Figure 1.1: "inward-out"). In other words, the agency of carrying out the function of protecting and moving an asset such as cash (value) must be purely divorced from the agency that wishes to be responsible for accessing it for ANY risk-related financial decisions.

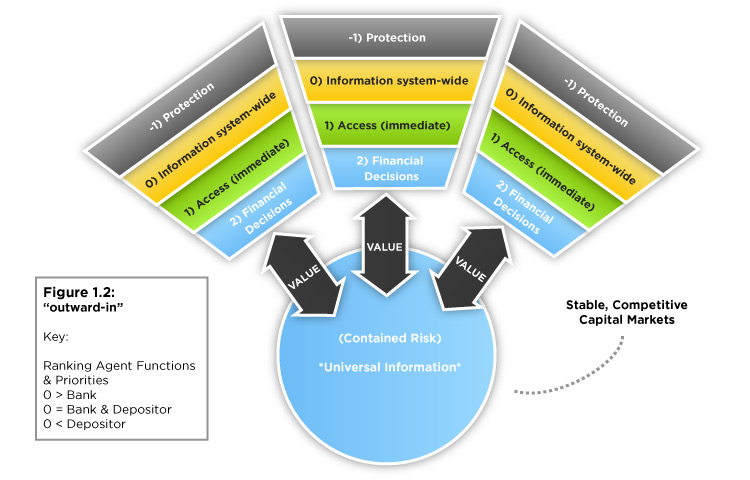

The functions of 1) protecting and moving an asset and 2) exposing an asset to risk are perfectly polar opposites in terms of their "agencies", or interests. By not ignoring what we know to be true about the systemic principal-agent problem in banking, EQC is forming a new type of "bank" that maintains an ethically-sound business model by providing an "outward-in" approach of operating (see Figure 1.2: "outward-in"). This new type of business model takes absolutely NO role in investment. Instead, it only protects assets (money), ensures its expedient movement, and provides the public access to perfectly-accurate and contemporaneous information about any non-private movement inside the system (taxes, investment, etc.). Resulting financial decisions (again: taxes, investment, etc.) executed via transactions within EQC (access to money AND information) are then the most competently informed, instantaneous, and in no way influenced by the agency enlisted to protect, facilitate, and measure the movement of assets under management. Users become their own "banks" and risk-takers; EQC functions as their accountant.

Upon preliminary examination, the U.S. Department of Treasury's Office of the Comptroller of the Currency has stated that these are services that EQC "could offer without the constraints and regulatory requirements of being a bank. As [EQC] indicated in the material we read through, [it is] not seeking a charter as a 'bank' as defined in the National Banking Act of 1864. Our agency only charters national banks and federal branches and agencies as defined in the National Banking Act. (OCC. 2009-06-24)" The purpose in using a system-clock to run a system-accounting platform is to provide for immediacy and absolute transparency throughout an economy because all events, both current AND expected, can be facilitated and measured automatically. Public access to such information (i.e. information which they have a right to access) will ensure that the perception of value remains as objective as possible. Over-valuing the future performance of a business, a tax policy, or an asset in general will be exceedingly difficult to do given the informative potency of system-accounting. This makes the platform extremely vital in preventing the misrepresentation of any economic data whatsoever. Trying to commit fraud or funding terrorism would not be attempted by those who would normally consider perpetrating such crimes outside the system; and if they did, EQC can vastly increase the efficiency of law-enforcement by providing assistance where courts formally request it. How It Works At The Micro LevelEQC's storefront will be completely internet-driven and operate similar to any social network site with one very important difference: it is a "value network", i.e. a network that exploits the elimination of space and time whereby the movement of cash, which is just "the change in ownership of value", is NOT subject to clogging, freezing, bad information -or any other systemic inefficiencies currently tolerated in a system that actually rewards the mere possession of money. If overnight lending can still earn a return for banks in the old system, then that system will never accept settling all transactions immediately. Thus, depositors will never get the opportunity to know exactly what they own at all times because their banks are busy exploiting access to money in transition (between one another). With capital markets already being hindered by high entry barriers, it's of course no further benefit whatsoever that such information about the movement of value between banks is hardly discernable to the public. In the end these same banks will double-back and exploit the absence of immediate information regarding "the change in ownership of value" at the depositor level by levying over-draft charges when their depositors make decisions lacking time-sensitive information. All these issues are just tactics used to exploit asymmetry in information that EQC will eliminate. Waiting for value (cash) will no longer occur, and neither will the profit-schemes dependent upon the timely uncertainty of its ownership. As stated before, divorcing the service of protection from investment will mark an enormous leap forward especially now that all non-private information about the movement of value will be merged with its access. The doors leading to the global capital market will be completely removed because observing financial performance by those who wish to attract investment capital will be done with the click of a button. No amount of brokers, "bankers", or gossip will be able to eclipse the objectivity provided by the system-accounting platform.

Physically Using The Application

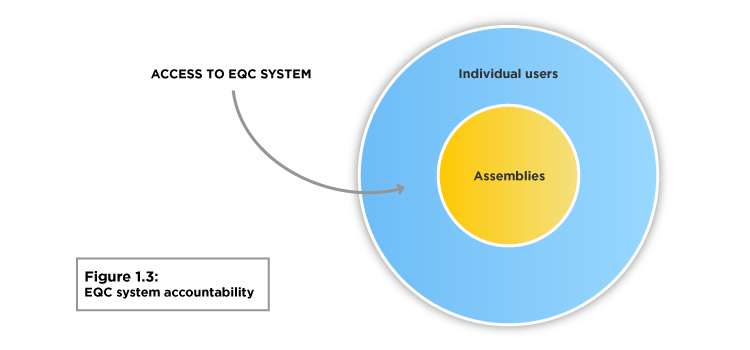

EQC's interface won't be much different from any other social network in existence consisting of users and groups of users. User: since EQC is hosting a network, it keeps the expression "user" to literally indicate a single human being. Because the Users are the masters of the land, they become completely accountable for the decisions being made within the system (figure 1.3: EQC system accountability).

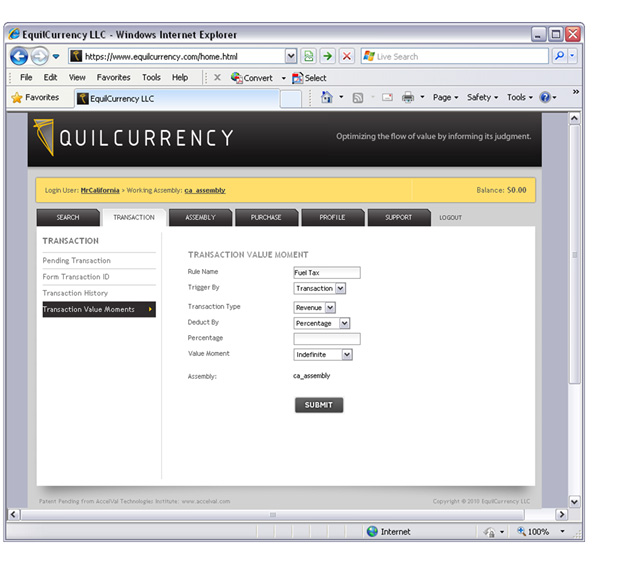

Assembly: generally indicates a group of human beings working together for some common purpose. However, there are also companies operated by a single individual. This means that the services people offer are separate from their identity as human beings. Therefore, an assembly may simply refer to a type of labor or skill being offered to the market at-large by a human being. All cash within the system moves at the assembly level. With assemblies as the major work-worse, Users drive them to plough their way through the terrain of trade. Primary transaction: an economic event (revenue, transfer payment, donation, etc.) where a transaction is originated between a buyer and a seller, or payor and payee, for the purpose of carrying out a payment. Secondary transaction: if an independent economic event such as revenue is expected to be taxed, the secondary transaction is automatically carried out as a means of fulfilling any and all dependent economic events (e. g. government immediately receives payment). Hence, a cascade of secondary transactions can be completed by the precipitation of one single primary transaction. Transaction ID (TID): are how transactions get done. It is the single instrument responsible for triggering the movement of cash (change in ownership of value). Completed TIDs are what give EQC the ability to measure and provide public access to all non-private information concerning revenue, gross profit, prices, taxes, etc., moving throughout the system in a given period. Value Moments: promises that automatically get fulfilled when predefined events trigger them. Basically, value moments automatically create and approve TIDs as secondary transactions. When Users make promises between one another, for example:

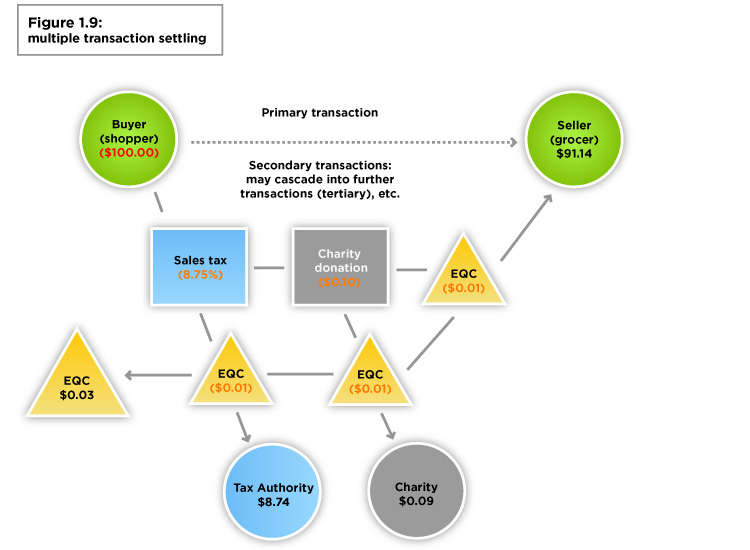

Again, folks know these as promises but those who are familiar with mathematics know these concepts to be vectors (having magnitude and direction). Using the system-clock, EQC sees to it that the instant any of these predefined events occur, a value moment is triggered and the promise is fulfilled by completing a secondary transaction. Imagine swiping a card at the grocery store and, while paying for the goods (see figure 1.3: multiple transaction settling):

Yes. This is now possible with EQC. Digital credits: also known as just "credits", these are used to represent the lowest denomination of currency (pennies) being held and accounted for at EQC's trust account with the now government-owned Citibank. Credits behave as "schedule-keepers of value", meaning that instead of pennies being flung around the country waiting to be put in the hands of their owners so that they can hold them up high and scream, "Hey, I own this!" credits now do it for them because users are owners; and as long as users have access to credits (insert internet here) timely recording ownership of value itself is all that matters in the cash management business (not its physical possession). Actual cash stays put with the government for safe-keeping, and EQC performs system-wide accounting on behalf of all elements in an environment that is designed to maximize the rate of trade via eliminating market inefficiency.

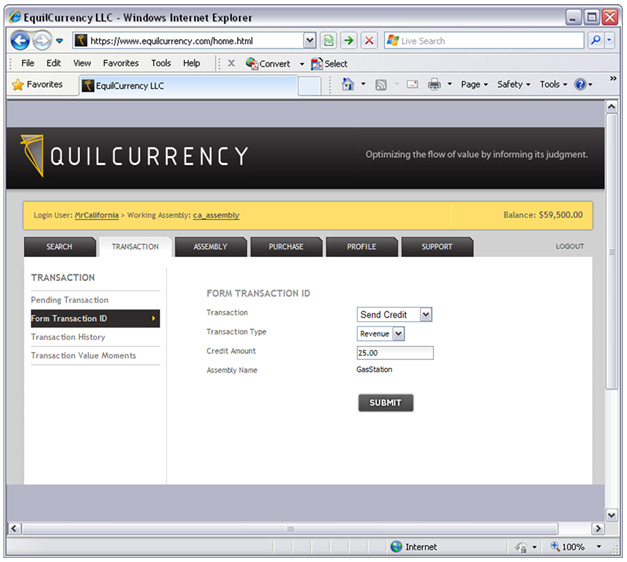

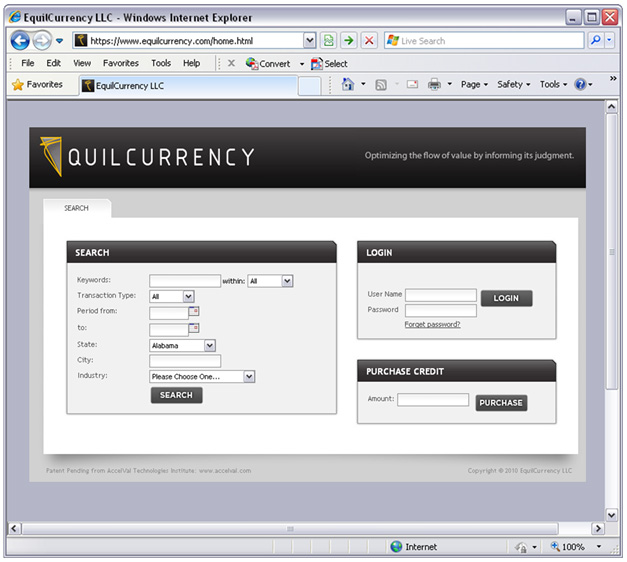

Understanding By VisualizingIt's not difficult to paint a picture of how EQC will function if one is familiar with a company like Facebook, albeit the technology responsible for creating the economic data for public and private access is the real brains of EQC. Functionally, it won't be much different from the social websites known around the internet today. 1) You log into your user via computer or mobile phone (See next page for figure 1.4: login),

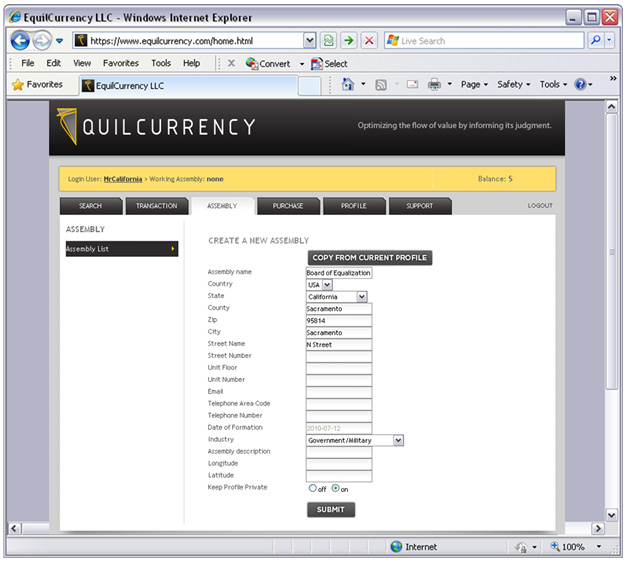

2) Create your assemblies (figure 1.5: value networks),

3) You send "information" between one another (figure 1.6: standard revenue transactions, figure 1.7: value moments),

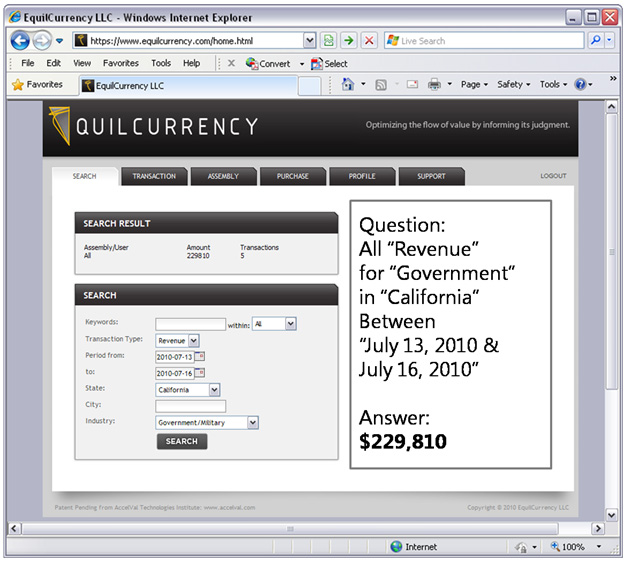

Whereas social networking sites make it easy to electronically transmit text containing information about a user's favorite ice cream, EQC's value network makes it simple for users to electronically transmit numbers representing how much value (cash) they're literally exchanging for its consumption. Settling all other claims on the transaction such as taxes and dividends, in the meantime, is automatic. What's more is that if the ice cream business wishes to attract investment capital, it may at any time reveal its financial performance online in real-time. Goodbye Wall Street! And if taxpayers want to know exactly how their government's fiscal strategy is performing in real-time, again no problem (see figure 1.8: economic search query).  Personal details regarding purchases remain private, but the economy will be able to observe that revenue in the ice cream business in a certain geographical location was earned at that particular moment, and tax revenue to a specific government entity was immediately collected. There, the internet has officially become a place for grown-ups ;)

EQC Business ModelEQC earns its revenue by completing transactions. Naturally, it is incentivized to complete as many as possible for the universal benefit of moving money immediately. No other option will be nearly as effective as EQC because of the use of its value moments which are made possible by the system-clock. The amount levied by EQC for each transaction is $0.01. By keeping this price to the absolute minimum, business owners and government alike will appreciate the significant transaction cost reduction as they observe a commensurate impact to their bottom lines. In addition, the advantages afforded them by the removal of major administrative and accounting burdens will also be substantial.

Immediate Implementation For GovernmentCompanies sell goods and services to the government all the time. What does the government have to show for it lately? A lot of debt and very little appreciation. It's not often that a company comes around and proves it can restore all the billions of dollars literally lost by the government due to inefficiency. However, that time has arrived, and EQC's technology proves that it is capable of having this exact impact. Cities with California are currently spending their redevelopment money in hopes of influencing some kind of increase in the sales tax collected by the state. It is only when the state earns more in sales tax that cities who are weak on property tax revenue have a chance in seeing more financial support. Helping a business repave their parking lot may possibly generate an increase in revenue to the state. On the other hand, those same resources could very well be used to enable the public to adopt the system-accounting platform. The difference in how these two scenarios will increase tax revenue to the state, and subsequently cities, is extraordinary at first glance. Encouraging the use of a technology that guarantees the State of California absolute fidelity on tax commitments in a timely and transparent manner would yield a substantial increase in tax revenue; much more so than any return on investment sought through a redevelopment subsidy. "Repainting and repaving" the old model for banks isn't going to spell out deliverance for the people, either. Like clockwork, the massive tidal waves that must eventually emerge due to uncontained risk, a poorly functioning financial system, and an under-competitive capital market means that no matter what amount of taxes the government tries to collect, the system HAS arrived at terminal velocity. Adopting EQC for the use of its system-accounting platform to maximize tax collection efficiency and transparency will begin an era of fiscal stewardship the likes of which has never been witnessed. Paying down debts, increasing tax flow through to localities, and implementing pure transparency will restore the trust of the people in their system. It's also worth remembering that mankind didn't break the sound barrier because it kept trying to patch up one of these:

Figure 2.1: old ...no, we scrapped that junk and did it with one of these:

Figure 2.2: new If we want to take breaking the current economic barrier seriously, our system needs access to a whole new kind of technology that emphasizes acceleration, not growth. Once the financial wolves are told to give up their facade as shepherds and told to rejoin markets as investors (i.e. instead of "bankers"), then playing survival of the fittest in an environment where everyone knows the price of everything (including the cost of earning a return) will create the kind of market equilibrium we've all been waiting for. Creating an influx of the desperately-needed tax revenue to the state must be an immediate priority. Using EQC will most certainly make it possible to eventually lower tax rates once current debts are serviced. Transparency, efficiency, and a whole new era where people are able to ethically seek the highest risk-adjusted rate of return using the most pertinent financial information that is universally accessible has begun.

I look forward to testing EQC's service with a few localities pending the state's consent as soon as possible.

Sincerely, Max Funk

Copyright 2010 |

|

|